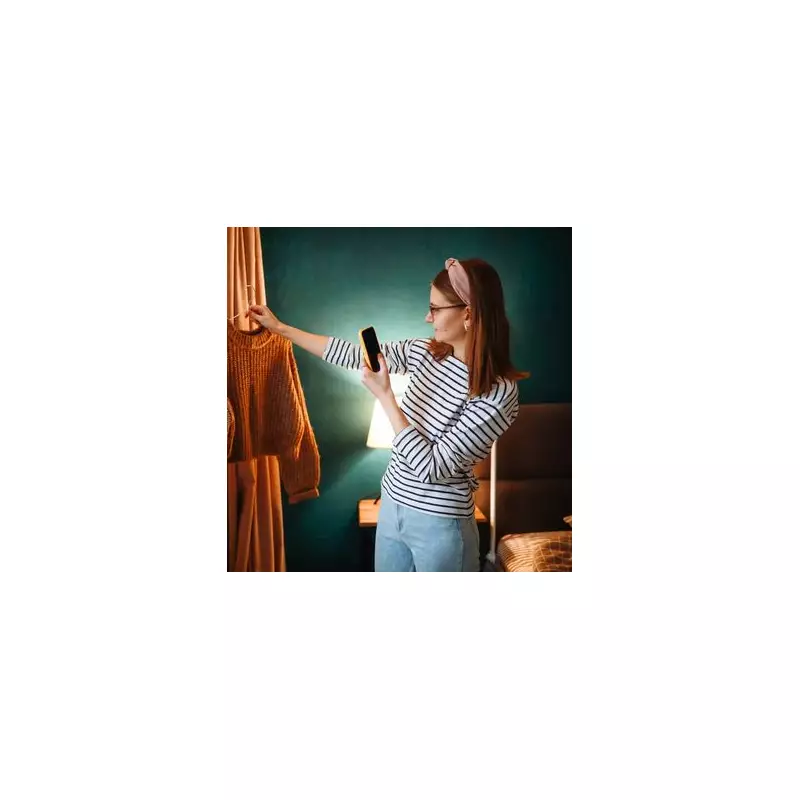

Thousands of Britons selling clothes and second-hand items through popular platforms like Vinted, Depop and eBay could face unexpected tax bills under new HMRC rules coming into force this year.

What's Changing for Online Sellers?

From January 1st, 2024, digital platforms including Vinted, Depop, eBay, and Airbnb are now required to collect and report seller information directly to HMRC. This dramatic shift in tax enforcement means the taxman will have unprecedented visibility into side hustle earnings.

Who Needs to Worry About This?

The new rules primarily affect two groups of sellers:

- Casual sellers who exceed the £1,000 trading allowance threshold

- Regular traders who use these platforms as a business venture

However, there's important relief for occasional declutterers. "If you're simply selling old clothes from your wardrobe that you no longer want, you won't be affected," explains a tax specialist. The key distinction lies between genuine spring cleaning and systematic trading for profit.

Understanding Your Tax Obligations

HMRC's trading allowance provides a £1,000 tax-free buffer for casual income. But once your earnings exceed this amount, you're legally required to:

- Register for self-assessment

- Complete an annual tax return

- Pay income tax on profits above the allowance

What Platforms Are Doing Differently

Major selling platforms are now implementing new reporting systems that will automatically share seller data with HMRC. This includes:

- Number of transactions completed

- Total sales volumes

- Seller identification details

The first data reports will be submitted to HMRC in January 2025, covering all of 2024's trading activity.

Protect Yourself from Penalties

With HMRC's enhanced digital tracking capabilities, the days of flying under the radar are over. Tax experts warn that failing to declare taxable income could result in:

- Substantial financial penalties

- Back-tax demands with interest

- Potential damage to your credit rating

The message is clear: If you're earning significant money through online platforms, it's time to get your tax affairs in order. Keeping proper records and understanding your obligations could save you from an unwelcome surprise from the taxman.