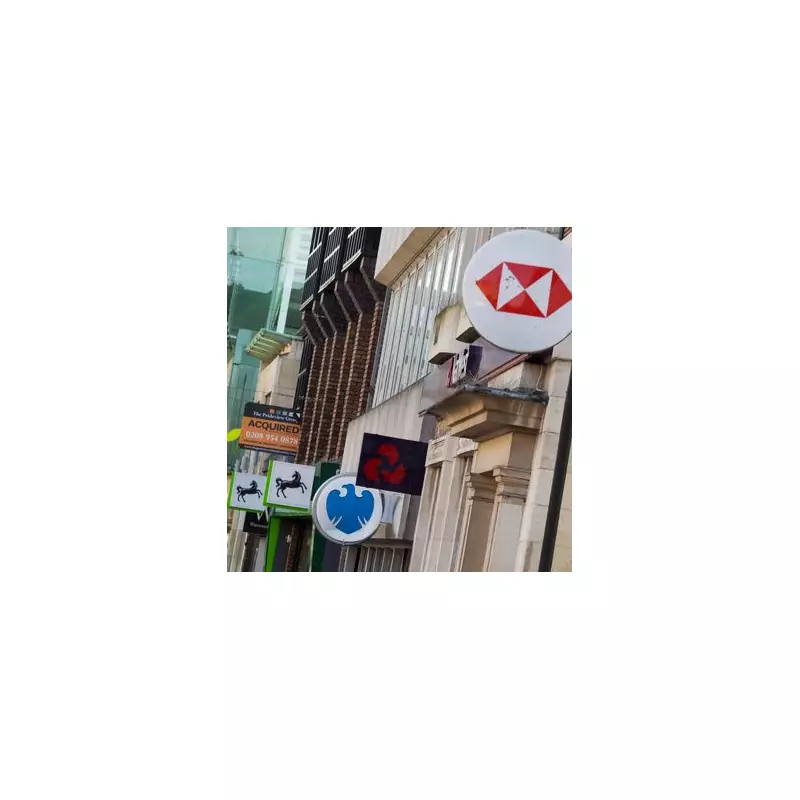

The UK's high streets are set to lose more than 100 bank branches in 2026, as major financial institutions accelerate their retreat from physical locations in favour of digital services.

The Scale of the 2026 Closures

So far this year, closure dates have been fixed for 73 branches operated by the country's leading banks. Another 29 branches have announced plans to close but are yet to set a final date, bringing the total confirmed and planned closures to 102.

The Lloyds Banking Group is leading this wave of shutdowns, with a total of 40 Lloyds, Halifax, and Bank of Scotland branches either approaching their final day or awaiting a confirmed end date. This includes 17 Bank of Scotland and 15 Halifax closures. Santander follows with 18 branches slated to close, while NatWest has scheduled 7 branch closures.

Timeline and Regional Impact

The closures are happening swiftly. 35 branches will have vanished by the end of January 2026, with two more following in February and an additional 23 in March. The remaining closures are scheduled for July and October, or are yet to be determined.

Geographically, Cornwall has been hardest hit. Four banks are already scheduled to close there this year, with two more pending a date. This continues a devastating trend for the county, which has lost 45 bank branches since 2022.

Scotland's Highland council area is also facing significant losses, with six banks set to close. In total, Scotland will lose 20 banks, Wales will lose five, and Northern Ireland one. In England, the South East and South West are the worst affected regions, with 17 closures each.

The Shift to Digital and the Safety Net

Banks have consistently blamed these decisions on a dramatic shift in customer behaviour, with millions moving to mobile and online banking. Since February 2022, under a voluntary agreement to assess the impact of closures, a staggering 2,065 branches have either shut or announced plans to close—an average of at least one per day.

To mitigate the impact, the LINK initiative assesses every planned closure. Where communities are left without any bank, banking hubs or free ATMs are established. Nick Quin, LINK's Chief Corporate Affairs Officer, stated: "More people are choosing to bank and pay for things digitally... but [cash] remains critical."

Gareth Oakley, CEO of Cash Access UK, highlighted the growth of banking hubs as a solution, noting: "We've opened more than 200 now, including 100 in 2025 alone... They're getting busier too with on average around 150 customer transactions every day." These hubs allow customers of all major banks to access face-to-face services and cash in one shared location.