As interest rates continue to fluctuate, a significant generational divide is becoming apparent in how Britons approach their savings and banking relationships. While older savers are increasingly adopting sophisticated "laddering" strategies to maximise returns, younger generations appear to prioritise immediate perks and lifestyle benefits over traditional financial metrics.

The Savings Ladder Strategy Explained

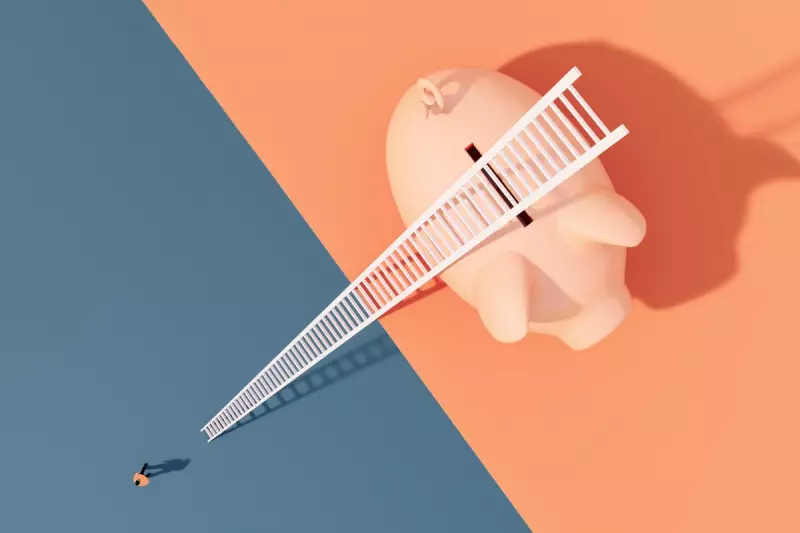

Recent data from Investec reveals that approximately four in ten adults are now implementing what has become known as the "savings ladder" approach. This method involves dividing savings across multiple fixed-term accounts with staggered maturity dates, ensuring a constant supply of cash becomes available at regular intervals.

Each time a fixed-term account matures, the principal plus accumulated interest creates what savers metaphorically describe as a new "rung" on their financial ladder. This cash is then typically reinvested into another fixed-term arrangement, creating a continuous cycle of accessibility and growth.

Benefits and Drawbacks of Fixed-Term Savings

The primary advantage of fixed-term accounts, often called bonds, lies in their predictability. Savers are guaranteed a specific return regardless of fluctuations in the Bank of England's base rate during the investment period. These accounts typically offer terms ranging from six months to several years, with some featuring specific maturity dates.

However, this security comes with a significant trade-off: restricted access. Funds placed in fixed-term arrangements are generally locked away for the duration, with early withdrawal typically incurring substantial penalties. This creates a balancing act between security and accessibility that different generations approach quite differently.

Generation Z's Alternative Priorities

While older savers focus on maximising interest through structured approaches, research from pay.uk's Current Account Switch Service reveals strikingly different priorities among younger demographics. For Generation Z, banking perks frequently outweigh traditional financial benefits.

The data presents compelling evidence of this shift: seventy-two percent of younger adults value banks that reward everyday spending over those focusing on financial milestones. Furthermore, fifty-one percent stated that perks including free coffees, food discounts, and cashback schemes held greater appeal than marginally higher interest rates.

Perhaps most tellingly, fifty-three percent of respondents indicated they would switch banking providers specifically to access better lifestyle perks, suggesting a fundamental re-evaluation of what constitutes value in financial services.

The Property Aspiration Paradox

This generational divergence creates something of a paradox. Barclays Property research indicates that young adults remain remarkably confident about their prospects of entering the property market, with thirty-four percent of 18-34-year-olds aiming to purchase a new or first home this year—more than double the UK average of sixteen percent.

Yet simultaneously, this demographic appears less concerned with optimising interest earnings that could accelerate their savings toward deposit goals. This creates a complex picture where long-term aspirations coexist with short-term preference for lifestyle benefits over financial optimisation.

Broader Savings Concerns Across All Ages

Beyond generational differences, concerning trends emerge regarding the nation's overall savings resilience. A Standard Life report reveals that more than one in five UK adults (twenty-one percent) would need to incur debt to cover an unexpected expense of just £250.

While estimates vary, approximately one quarter of Britons are believed to have total savings below £1,000, with women disproportionately affected according to AJ Bell data. This suggests that regardless of strategy or generational approach, building adequate financial buffers remains a widespread challenge.

The Psychological Dimension of Savings

Kevin Mountford, co-founder of Raisin UK, emphasises the psychological aspects of savings behaviour. "Only thirty-five percent of people say they feel confident and in control of their savings," he notes, "while many admit to feeling worried, anxious or frustrated about their financial situation."

Mountford highlights how savings management often competes with numerous other daily priorities. "When time and energy are stretched, it's easy for savings to slip into the background, even though they can play an important role in overall peace of mind," he observes.

He concludes with a broader perspective: "Ultimately, financial wellbeing isn't just about how much you have saved. It's about feeling equipped and confident to make the right decision for your situation. Simple steps like reviewing your savings strategy, understanding how your money is working for you, and taking advantage of competitive interest rates can make a meaningful difference to both financial resilience and peace of mind."

Implications for Financial Institutions

This generational divergence presents a significant dilemma for banks and building societies as they develop products and services. Institutions must now cater to two distinct approaches: the methodical, interest-focused strategies favoured by older savers, and the perk-driven, lifestyle-oriented preferences of younger customers.

The challenge lies in creating offerings that address both mindsets while maintaining profitability and customer satisfaction across diverse demographic segments. As savings behaviours continue to evolve, financial providers face increasing pressure to innovate beyond traditional interest-based models to remain relevant to changing consumer expectations.