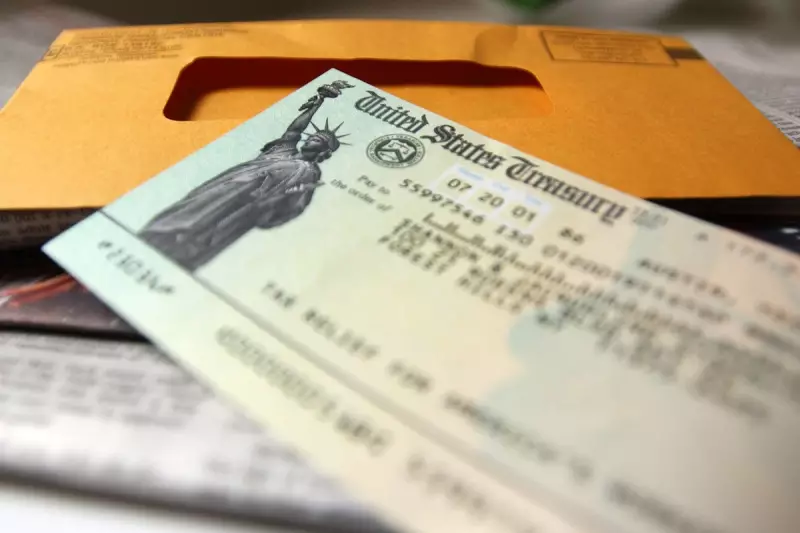

Significant changes to the United States tax code are poised to deliver substantially larger refunds for millions of American taxpayers this filing season. The Internal Revenue Service (IRS) commenced acceptance of 2025 federal tax returns on Monday, marking the first tax season influenced by the sweeping reforms enacted under the Big Beautiful Bill Act, which President Donald Trump signed into law last summer.

Potential for Substantial Refund Increases

According to data from the IRS, approximately 75 percent of Americans receive a tax refund each year, with the average amount in 2025 standing at $2,939. Reports from USA Today suggest that refunds for the 2025 tax year could surge by as much as 30 percent for many individuals, directly attributable to the provisions within the new tax legislation. Financial experts are strongly advising taxpayers to familiarise themselves with these alterations, as they may unlock additional financial benefits.

"Any time people have big life changes or there are law changes, people can miss benefits they’re entitled to," cautioned Andy Phillips, Vice President of H&R Block’s Tax Institute, in a statement to the Wall Street Journal. The onus is on filers to ensure they claim all eligible deductions and credits under the revised rules.

Key New Deductions for Seniors and Workers

Among the most notable changes are new deductions specifically designed for older Americans and certain workers. Taxpayers aged 65 and over who pay taxes on their Social Security income are now eligible for a federal deduction of $6,000, applicable through the 2028 tax year. Married couples where both spouses qualify can claim a combined deduction of up to $12,000.

Furthermore, the legislation introduces deductions for qualified overtime pay, capped at $12,500 for individual filers and $25,000 for those filing a joint return. Workers who earn tips may also qualify for a deduction of up to $25,000, although it is noted that this income might not be reported on standard W-2 forms. To claim these new deductions for seniors, tips, and overtime pay, taxpayers must utilise the newly introduced Schedule 1-A form when submitting their 2025 returns.

Revised SALT Deduction Limits and Standard Deductions

The Big Beautiful Bill Act also brings a temporary but significant increase to the cap on the state and local tax (SALT) deduction. The limit has been raised to $40,000, a substantial jump from the previous $10,000 ceiling. This adjustment is particularly beneficial for higher-income taxpayers residing in states with elevated tax burdens, allowing them to deduct a greater amount on their federal tax returns.

For the 2025 tax year, the standard deduction amounts have been set at $15,750 for single filers and $31,500 for married couples filing jointly. These figures represent an increase of $750 and $1,500 respectively from the previous year, incorporating both legislative changes and standard inflationary adjustments made by the IRS. While taking the standard deduction remains the most advantageous route for the majority of taxpayers, the Wall Street Journal reports that this year's specific changes could make itemising deductions a more financially prudent choice for some individuals.

Enhanced Child Tax Credit and New Retirement Accounts

The new law also enhances family-oriented benefits. The maximum child tax credit has been raised to $2,200 per eligible child. Additionally, last year's legislation established a novel type of retirement savings vehicle, colloquially termed a "Trump account." For each child born between 2025 and 2028, the government will contribute $1,000 into this account, providing a foundational boost for future educational or retirement needs.

As the 2026 tax season gets underway, these comprehensive reforms underscore a period of transition for American taxpayers. The combination of increased deductions for seniors and workers, higher SALT limits, and enhanced credits for families is projected to have a tangible impact on the bottom line for countless households across the nation.