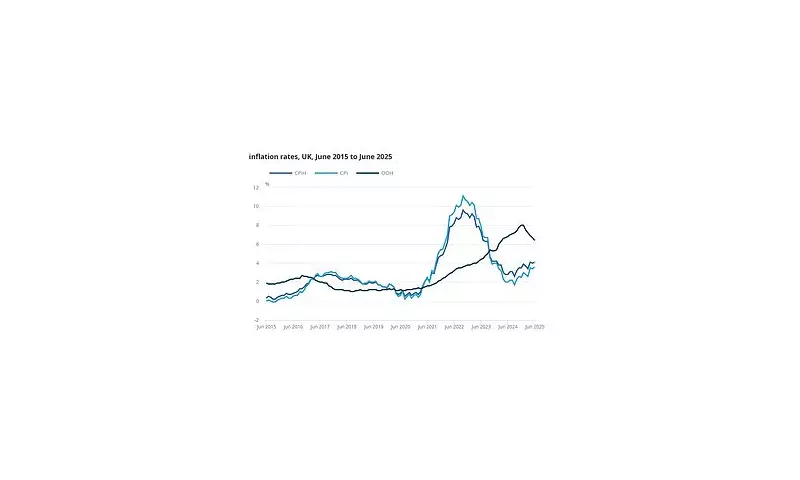

In a dramatic twist for the UK economy, inflation has surged to 3.6% this month, defying expert forecasts and delivering a fresh headache for Chancellor Rachel Reeves. The unexpected rise dashes hopes for imminent interest rate cuts and raises new questions about the country's economic stability.

Economists Left Stunned

Analysts had widely predicted inflation would continue its downward trajectory, with many anticipating a drop below 3.5%. Instead, stubborn price pressures across key sectors including food, transport and services have pushed the Consumer Prices Index (CPI) higher.

Political Fallout Begins

The figures represent a significant setback for the Chancellor, who had been banking on falling inflation to ease pressure on household budgets. Opposition MPs were quick to seize on the numbers as evidence of economic mismanagement.

Bank of England in Bind

The surprise inflation jump leaves the Bank of England with limited room for manoeuvre. Governor Andrew Bailey now faces an agonising decision on whether to maintain punishingly high interest rates or risk letting inflation run wild.

Sector-by-Sector Breakdown

- Food prices: Up 4.2% annually, with staples like bread and milk seeing sharp increases

- Transport costs: Rose 5.1% due to higher fuel prices and air fares

- Services inflation: Remains stubbornly high at 6.3%, driven by wage pressures

Economists warn that without significant improvement in the coming months, the UK could face prolonged economic pain with both businesses and consumers feeling the squeeze.