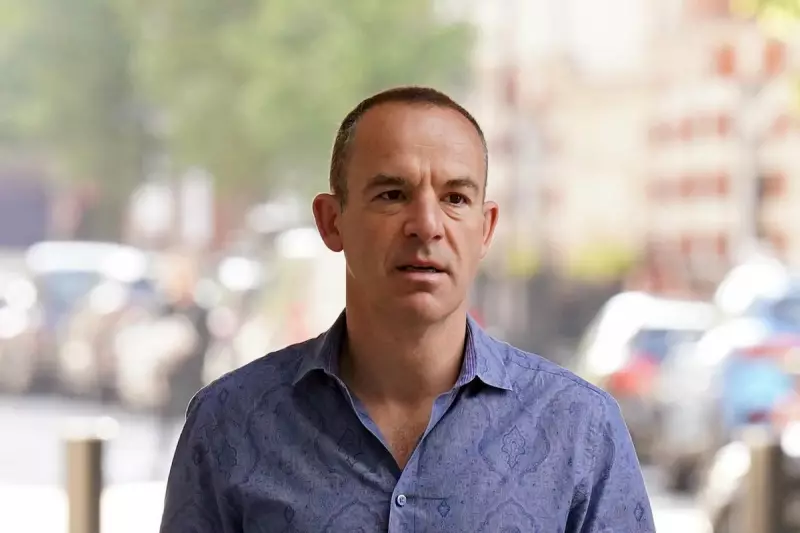

Money saving guru Martin Lewis has unveiled a surprisingly simple yet effective trick that could help drivers across the UK slash their car insurance costs. The consumer champion demonstrated that making a minor, entirely legal adjustment to how you describe your profession on insurance applications can lead to substantial savings on your annual premium.

The Job Title Price Discrepancy

During his popular Martin Lewis Money Show Live programme broadcast on Tuesday, 27 January 2026, Lewis presented compelling evidence of how insurance providers assign different risk profiles and consequently different prices based on job titles alone. He highlighted a specific case study that revealed a stark contrast: individuals listing their occupation as 'beautician' were being quoted significantly higher premiums than those using the title 'beauty technician', despite the roles being fundamentally similar.

Legitimacy is Paramount

Lewis issued a stern and crucial warning to viewers, emphasising that any alteration to a job title must be accurate, truthful, and reflect the genuine nature of one's work. "The change must be legitimate," he stressed, explaining that it should be a different but equally valid description of the same profession, not a fabrication.

He provided a clear example of what constitutes fraud: an office administrator falsely claiming to be a driving instructor to secure a lower rate. Such deliberate misrepresentation could invalidate your policy, lead to prosecution, and result in severe financial and legal consequences.

How the System Works

The practice stems from the complex algorithms and actuarial data used by insurance companies. Providers analyse historical claims data associated with thousands of job titles, creating risk categories that directly influence premium calculations. Some titles are statistically linked to safer driving records or lower mileage, thereby attracting cheaper rates.

Lewis advised policyholders to carefully consider the specific wording of their occupation. If your job can be accurately described by several different titles, it is worth investigating which one insurers view most favourably. This might involve using more technical or specific terminology that better reflects your actual duties.

Practical Steps for Savers

For those looking to apply this advice, Lewis recommends the following steps:

- Use comparison websites to obtain quotes using slightly different but accurate job titles for your profession.

- Ensure any title you use truthfully represents your main income-earning activities.

- Never invent a job or exaggerate your role. Stick to factual descriptions.

- If in doubt, contact your insurer directly to discuss the most appropriate and accurate title for your circumstances.

This revelation underscores a broader issue within the insurance industry, where seemingly minor details on an application can have disproportionately large effects on the final cost. By being savvy and precise with language, consumers can legally navigate these quirks to keep more money in their pockets.