Australia is on course for a monumental financial windfall, with projections indicating it will pocket upwards of $17.6 billion from copper exports in the 2026-27 financial year. This surge follows the metal's price reaching an unprecedented all-time high this week, a development with profound implications for the global economy and Australia's resource sector.

The Driving Forces Behind Copper's Meteoric Rise

The spot price for copper soared to a record US$6.10 per pound on Wednesday, marking a staggering 40 per cent increase over the past six months. This dramatic ascent is primarily fuelled by severe global supply constraints, which are struggling to keep pace with insatiable demand. A significant new driver is the artificial intelligence revolution, with data centres requiring vast amounts of copper—up to 50,000 metric tonnes per site—for power and cooling infrastructure.

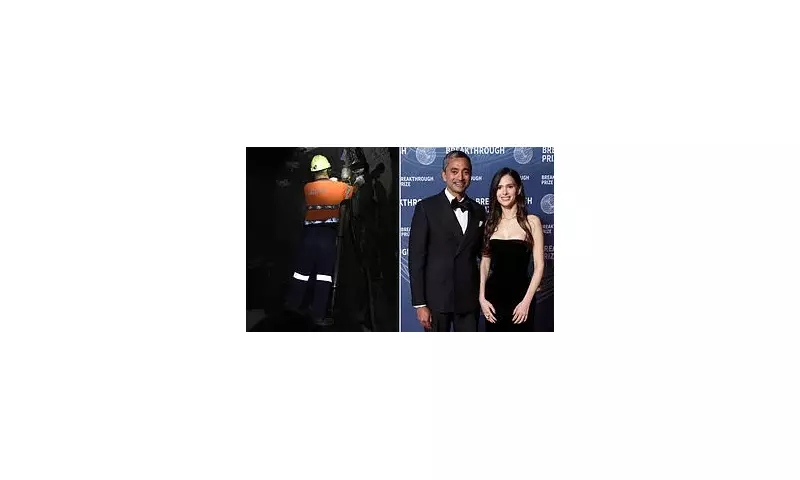

Investor sentiment is turning exceptionally bullish. Billionaire investor Chamath Palihapitiya, speaking on the 'All-In' podcast, predicted the asset is "set to go absolutely parabolic" in 2026. He highlighted copper's ubiquity in modern technology, from chips and weapon systems to renewable energy, warning that by 2040, the world could face a 70 per cent shortfall in supply at current consumption rates.

Political decisions have also tightened the market. In 2025, the Trump administration imposed a 50 per cent tariff on imported copper to boost US self-reliance. However, this move inadvertently restricted domestic supply, applying further upward pressure on international prices.

Australia's Position in the Global Copper Landscape

Australia stands as a primary beneficiary of this price surge. According to a report from the Department of Industry, Science and Resources, the nation earned $12.6 billion from copper exports in 2024-25. The forecast for 2026-27 now sits at a colossal $17.6 billion, underscoring the sector's growing economic importance.

This potential is particularly notable given Australia's current production status. While the country holds the world's second-largest copper reserves, estimated at 100 million tonnes, it ranks only as the eighth-largest global producer. This disparity highlights significant room for growth and investment in extraction and processing capabilities to capitalise on its vast natural endowment.

Broader Precious Metals Rally and Investor Caution

The commodity boom is not confined to copper. The wider precious metals market has experienced explosive growth, with silver prices surging by 150 per cent and gold also posting sharp gains. Last October, Australian investors were seen queuing outside ABC Bullion in Sydney's Martin Place as gold hit a record high of AU$6,033.80 per troy ounce.

Nicholas Frappell, Global Head of Institutional Markets at ABC Refinery, noted a broadening appeal for gold as a protective asset during times of market instability and inflation. However, experts urge a measured approach. Duncan Burns, Vanguard's chief investment officer for Asia-Pacific, cautioned that "precious metals are nonproductive assets" which generate no income, unlike shares or property. He warned that past performance does not guarantee future returns that outpace inflation.

As the world's energy transition and technological advancement accelerate, copper's role as a critical industrial metal is only set to expand. For Australia, with its enormous reserves, the current price rally represents a historic opportunity to bolster its export revenues and solidify its position in the global supply chain for decades to come.