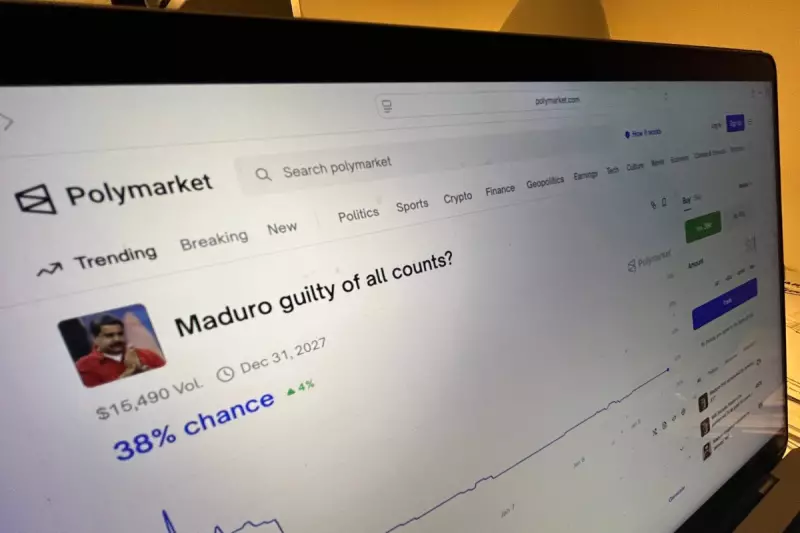

The shadowy world of online prediction markets faces intense new scrutiny after an anonymous trader netted a windfall exceeding $400,000 for correctly wagering on the imminent capture of Venezuelan leader Nicolás Maduro. The lucrative payout, executed on the platform Polymarket, has ignited fierce debate over potential insider trading and the largely unregulated nature of these speculative arenas.

The Suspicious Timing of a Massive Win

According to reports, the vast majority of the bets that led to the substantial payout were placed just hours before former US President Donald Trump announced a surprise night-time raid that resulted in Maduro's apprehension. This remarkably precise timing, coupled with the trader's otherwise minimal activity on the Polymarket site, has fuelled widespread online suspicion. Critics argue it points to the trader having prior, non-public knowledge of the impending military operation.

Others counter that the risk of exposure for any insider would be prohibitively high, and suggest the flurry of bets could simply reflect existing, rampant speculation about Maduro's precarious future. Polymarket itself has not responded to requests for comment on the controversial trade.

How Prediction Markets Operate and Their Explosive Growth

Prediction markets, which allow users to place financial wagers – known as 'event contracts' – on the likelihood of future events, have seen commercial use skyrocket. Users can bet on everything from election results and geopolitical conflicts to pop culture moments and social media trends. The price of a contract fluctuates between $0 and $1, directly reflecting the market's collective assessment of an event's probability, from 0% to 100%.

Proponents, like Wake Forest University economics professor Koleman Strumpf, argue that putting real money on the line leads to more accurate forecasts, citing past success in predicting events like the 2024 US presidential race. However, Strumpf cautions they are never a "crystal ball" and can be wrong.

The sector is now crowded with major players. Alongside market leader Polymarket, its top competitor Kalshi has gained regulatory approval for political and sports event contracts in the US. Sports betting giants DraftKings and FanDuel launched their own prediction platforms last month, while Robinhood is expanding its offerings. Notably, Donald Trump Jr. holds advisory roles at both Polymarket and Kalshi.

A Regulatory 'Huge Loophole' and Mounting Legal Challenges

In the United States, prediction markets operate in a significant regulatory grey area. Because they are framed as trading in event contracts, they fall under the oversight of the Commodity Futures Trading Commission (CFTC), not state gambling authorities. This allows them to circumvent state-level bans on traditional sports betting.

"It's a huge loophole," said Karl Lockhart, an assistant law professor at DePaul University. "You just have to comply with one set of regulations, rather than (rules from) each state around the country." This is particularly contentious in large states like California and Texas, where sports betting remains illegal but residents can wager on games via event contracts, prompting lawsuits from states and tribal groups.

The regulatory landscape has shifted dramatically with changes in the White House. The Biden administration aggressively cracked down, leading to a 2022 settlement that barred Polymarket from the US. Under the Trump administration late last year, Polymarket announced its return after receiving CFTC clearance. Meanwhile, the CFTC itself is grappling with reduced staffing and leadership departures, raising questions about its capacity for enforcement.

In direct response to the suspicions around the Maduro trade, Democratic Representative Ritchie Torres introduced a bill on Friday aimed at curbing government employees' involvement in politically-related event contracts. As the market for these 24/7 wagers expands, the call for greater transparency and robust oversight grows ever louder.