The London stock market closed a quiet Friday session with little change, as a retreat in heavyweight mining companies prevented the FTSE 100 from building on its recent record highs. Investors adopted a cautious stance ahead of a long weekend in the United States.

A Pause for Breath After a Busy Start to the Year

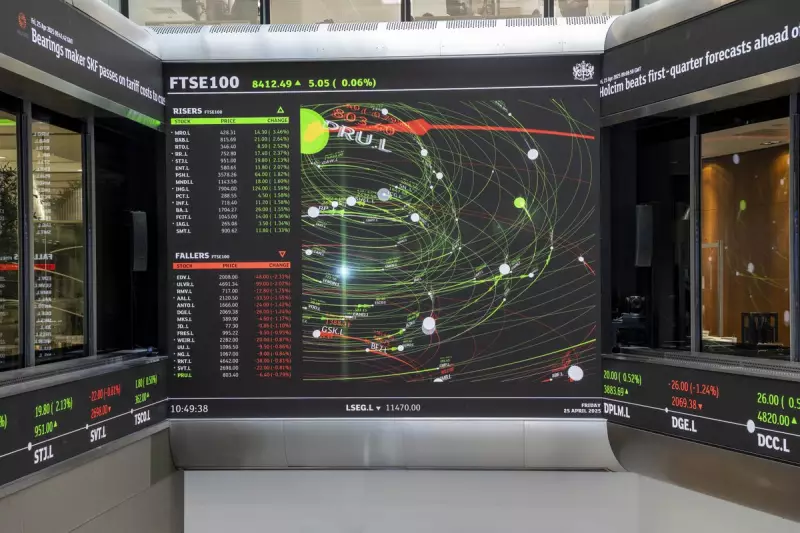

The FTSE 100 index closed down a mere 3.65 points at 10,235.29, having earlier touched a new intraday peak of 10,257.75. The mid-cap FTSE 250 fared slightly better, adding 31.39 points (0.1%) to finish at 23,311.37, while the AIM All-Share gained a marginal 0.27 points to 804.75.

Dan Coatsworth, head of markets at AJ Bell, noted the subdued mood. "Investors have been kept on their toes year-to-date with non-stop geopolitical issues and mixed messages from the business world," he said. "A quieter day on the corporate reporting calendar gave investors a chance to catch their breath and take stock of events."

For the week, the indices posted solid gains: the FTSE 100 rose 1.1%, the FTSE 250 climbed 1.2%, and the AIM All-Share advanced 2.1%.

Mining Sector Weighs as Strategists Sound Caution

The main drag on the blue-chip index came from the mining sector, which has been a key driver of recent strength. The sell-off followed a sharp drop in metal prices, with copper falling 3.0% and silver slumping 3.7%. Gold also softened, quoted at $4,594.24 an ounce, down from $4,616.76 on Thursday.

In response, shares in major miners declined: Endeavour Mining fell 2.7%, Anglo American declined 2.4%, Antofagasta dipped 2.9%, and Glencore lost 2.5%.

The pressure intensified after strategists at Bank of America downgraded the European mining sector to 'underweight' and lifted energy to 'market weight'. The bank warned that after sharp outperformance, "the potential downside risks stemming from the sector’s macro drivers are becoming hard to ignore."

BofA highlighted a significant divergence between metal and energy prices, noting the copper-to-oil ratio is near a 40-year high. This has led to European mining stocks outperforming by 40% since April, while energy has underperformed by nearly 15%. "Resources sector pricing looks stretched in both directions," the bank added.

Individual Stock Movers and Economic Data

Educational publisher Pearson ended a miserable week with a further 4.1% decline, bringing its total weekly loss to 12%. The fall was triggered by a poorly received trading update that revealed a previously undisclosed contract loss for US student assessment in New Jersey.

On a brighter note, property firms British Land and Land Securities gained 1.4% and 1.3% respectively on hopes that lower interest rates will spur a sector recovery. Defence giant BAE Systems rose 2.3%, remaining in favour amid ongoing geopolitical tensions.

In economic news, data showed US industrial production rose by a better-than-expected 0.4% in December. Shannon Glein, an analyst at Wells Fargo, noted a continued outperformance in "everything high-tech and AI related," a trend she expects to persist.

Looking ahead, Monday's global economic calendar features a slew of data from China, including GDP, retail sales, and industrial production figures. UK corporate updates are due from building materials firm Marshalls, with statements later in the week from Burberry, JD Sports Fashion, and Rio Tinto.

As markets paused, the pound was quoted at $1.3382 at the London close, slightly lower than Thursday's $1.3388.