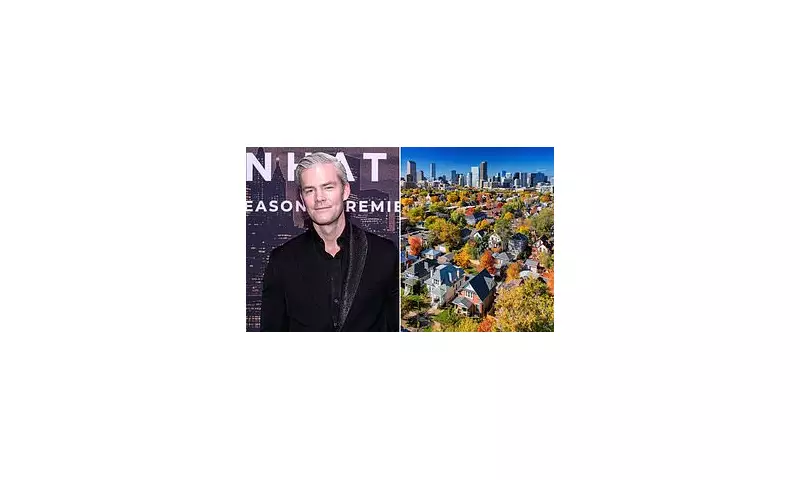

Ryan Serhant, the high-profile CEO of a global luxury brokerage and star of Netflix's Owning Manhattan, has made a bold prediction: the prolonged downturn in American property sales will finally conclude in 2026.

A Market Poised for Recovery

In an exclusive interview with the Daily Mail ahead of his show's second season premiere on 5 December, the 41-year-old broker outlined his optimistic outlook. This comes despite mortgage rates remaining stubbornly above six percent at the close of 2025. Serhant believes the market is set for a significant shift over the next twelve months.

"I think that rates will come down slightly, but not enough to cause a flood," he stated. He pointed to the expiration of ultra-low COVID-19 era mortgage deals as a key driver. "After three years of the COVID-19 rates locked in effect, people have to move." This, he forecasts, will lead to a 10 to 15 percent increase in home sales compared to the past three years—a rise he describes as sorely needed.

Serhant also anticipates a modest rise in median house prices, attributing this to a persistent and historically low inventory of available homes.

The Scale of the Crisis and New Ownership Models

The broker's predictions address a deep-seated crisis. Data from Redfin reveals that only 2.5 percent of US homes changed hands between January and August 2025, equating to just 25 per 1,000 properties—the lowest rate in at least three decades. During the 2021 boom, that figure was closer to 40 per 1,000.

The disappearance of affordable housing is central to the problem. The Daily Mail recently reported that the average entry-level house in 233 US cities now costs $1 million, nearly triple the average from five years ago, crippling first-time buyers.

In response, Serhant predicts the market will adapt through innovative ownership structures. "I think you're also going to start to see greater discussions on different forms of ownership," he said. He highlighted the growing trend of friends using Limited Liability Companies (LLCs) to buy property together, allowing them to easily sell shares and distribute profits. "The American Dream doesn't go away for home ownership at all, I think it's just adapting to the new world."

Wellness Replaces Wet Bars for Luxury Buyers

Serhant also identified a major shift in what wealthy buyers, particularly in New York City, now desire. The focus has moved decisively from entertainment to personal health and wellness.

"I've never had more people ask for infrared saunas and cold plunges at the same exact time," he revealed, noting the demand spans generations. This contrasts sharply with priorities from a decade ago, when wet bars were the must-have feature. Today's younger buyers are asking, "Where am I going to put my sauna?", "Where's my meditation cocoon?", and "Where's my gym?" The era of lavish party spaces is giving way to the home as a wellness sanctuary.