British shoppers demonstrated unexpected financial resilience during the recent holiday season, with new data revealing a significant uptick in expenditure despite widespread economic caution.

Data Confirms Consumer Confidence

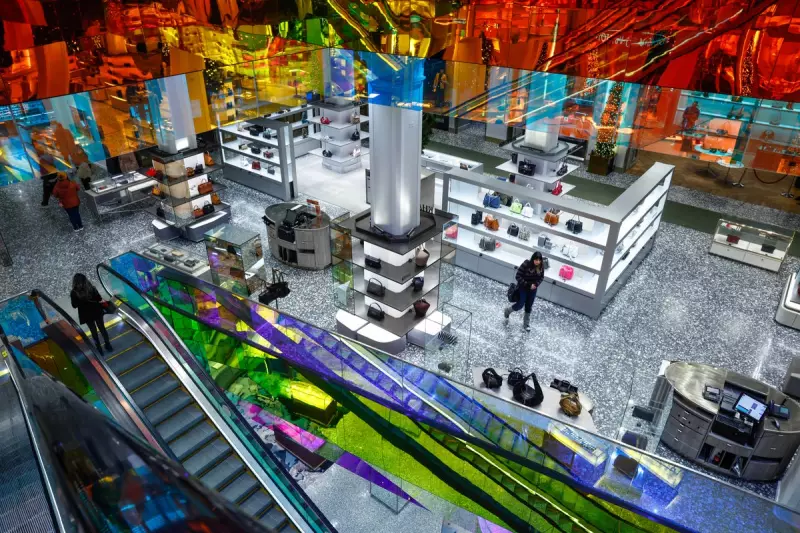

A pivotal report from the payment network Visa, published on Wednesday 24 December 2025, showed that overall holiday spending climbed by 4.2% compared to the previous year. The figures indicate a strong preference for physical retail, with nearly 75% of all consumer spending occurring in-store. Meanwhile, online sales experienced a robust 7.8% year-on-year increase.

Stephen Yalof, the Chief Executive of Tanger Outlets, which operates 39 outlet centres across the United States, echoed this sentiment in an interview with CNBC's Money Movers on Tuesday. "I feel like the customer is very resilient," Yalof stated. "They're looking to spend."

The Discount-Driven Shopper and AI Influence

Industry analysis suggests this spending surge was strategically calculated. Consumers proved highly responsive to discounts, a trend noted by cereal manufacturer General Mills during its third-quarter earnings call. Jeff Siemon, the company's Vice President of Investor Relations, observed that shoppers earning under $100,000 were particularly keen to purchase more when they encountered compelling price reductions.

Visa's Chief Economist, Wayne Best, highlighted a technological shift shaping shopping habits. "This season also marked a turning point, with artificial intelligence shaping how people discover products, compare prices, and interact with offers," Best said in a statement. This led to a more informed and intentional consumer, effectively stretching their discretionary budgets.

Retailers Adapt to the New Normal

In response to this price-sensitive behaviour, retailers have actively adjusted their strategies. Yalof confirmed that stores are discounting to attract customers, who are in turn responding by opening their wallets. "Retailers are discounting to meet the consumer, and the consumer is responding by shopping," he told CNBC.

However, the market also shows a segment of buyers willing to pay full price—or even slightly above their planned budget—for items they perceive as offering everyday value. Yalof described these shoppers as seeking spaces where they can buy products at a consistent, competitive price point they trust.

The top-performing category for the season was electronics, which saw sales rise by 5.8%. This data collectively paints a picture of a pragmatic yet confident consumer base, leveraging technology and promotions to navigate the economic landscape and fuel a stronger-than-anticipated holiday retail period.