In a dramatic move that has sent ripples through the British retail sector, high street titan Next has stepped in to rescue the venerable luxury footwear and handbag brand Russell & Bromley from collapse. The acquisition, valued at £3.8 million, was executed through a pre-pack administration deal, safeguarding the brand's intellectual property and heritage but casting a long shadow over the future of its physical store network.

A Storied Legacy on the Brink

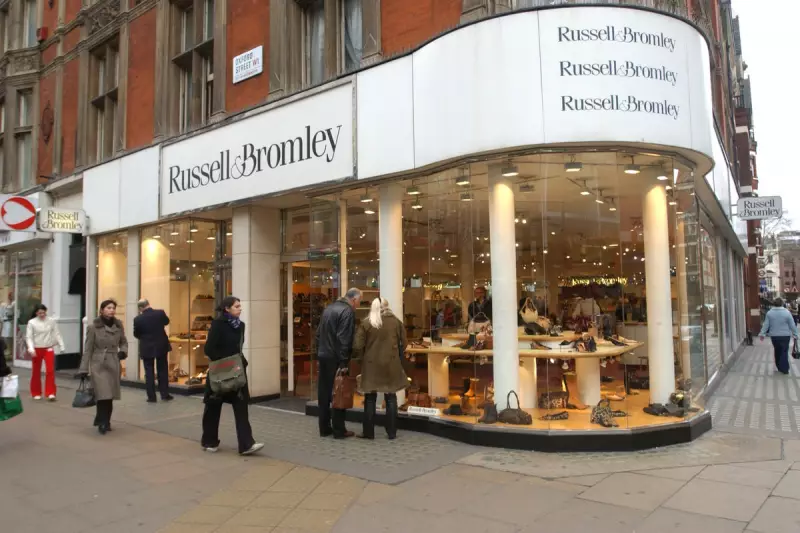

Founded in Sussex in 1879, Russell & Bromley has been a fixture of British high streets for nearly a century and a half, earning a reputation for premium craftsmanship and contemporary style. The specialist chain currently operates 36 standalone stores and nine concessions across the United Kingdom and Ireland, employing approximately 440 dedicated staff members. However, like many traditional retailers, it has faced mounting pressures in recent years, culminating in the need for this rescue intervention.

The Rescue Deal: What Next Acquires

Under the terms of the agreement, Next will pay £2.5 million to acquire the Russell & Bromley brand name and its associated intellectual property. An additional £1.3 million has been allocated for a portion of the company's existing stock inventory. This strategic purchase is designed to inject operational stability and expertise into the struggling brand, allowing it to refocus on its core mission of designing and curating world-class footwear and accessories.

The High Street Casualty: Store Closures Loom

While the brand's legacy has been secured, the future of its physical presence is far less certain. Next has confirmed it will retain only three of Russell & Bromley's prime retail locations: its prestigious outlets in Chelsea, Mayfair, and the Bluewater Shopping Centre. This decision leaves the remaining 33 stores and all nine concessions in a precarious position.

Administrators from Interpath Advisory are now tasked with exploring options for these locations, which continue to trade in the interim. Will Wright, Interpath's UK chief executive, stated: "Our intention is to continue to trade the remaining portfolio of stores for as long as we can, while we explore the options available." This process likely involves seeking new buyers or negotiating lease terminations, putting hundreds of retail jobs at potential risk.

Executive Perspectives on the Transition

In an official statement, Next outlined its vision for the acquired brand: "This acquisition secures the future of a much-loved British footwear brand. Next intends to build on this legacy and provide the operational stability and expertise to support Russell & Bromley's next chapter." The company emphasised its commitment to preserving the brand's quality craftsmanship and premium positioning in the market.

Andrew Bromley, chief executive of Russell & Bromley, addressed the difficult decision: "Following a strategic review with external advisers, we have taken the difficult decision to sell the Russell & Bromley brand. This is the best route to secure the future for the brand, and we would like to thank our staff, suppliers, partners and customers for their support throughout our history." His comments reflect the bittersweet nature of the transaction—securing the brand's survival while acknowledging the potential human and commercial costs.

The Broader Retail Landscape

This rescue deal occurs against a backdrop of significant turmoil on Britain's high streets, with several well-known names facing existential challenges. The acquisition strategy employed by Next—focusing on brand value and intellectual property rather than physical estate—highlights a shifting retail paradigm where digital presence and brand equity often outweigh traditional brick-and-mortar footprints.

As administrators work to determine the fate of the remaining Russell & Bromley outlets, the industry will be watching closely. The outcome may serve as a bellwether for how other heritage brands navigate the complex intersection of legacy, modern retail economics, and consumer behaviour in an increasingly digital marketplace.