Political Betting Surges as Over $200 Million Wagered Online

The landscape of political engagement is undergoing a dramatic transformation, with millions of dollars now being staked on global political outcomes through online prediction markets. This burgeoning industry, while capturing significant public interest, is simultaneously raising profound ethical questions and fears of insider trading among government officials.

Unprecedented Financial Stakes in Political Events

Recent analysis reveals that online platforms dedicated to political wagering are experiencing an explosive surge in activity. According to data scrutinised by The Washington Post from Dune Analytics, approximately 370,000 individuals are actively placing bets on politics through the platform Polymarket, with the total value of these wagers exceeding $90 million. Its primary competitor, Kalshi, reports an even larger sum, with around $129 million currently at stake on various political happenings, although it maintains a policy against accepting bets on events involving direct military action.

The focus of these wagers is intensely concentrated on American politics and the actions of former President Donald Trump. Bettors are speculating on a wide array of outcomes, from foreign policy interventions and military engagements to domestic matters such as the content of State of the Union addresses and the appointment of the next Federal Reserve Chairman. This commodification of political decision-making has drawn sharp criticism from ethicists who argue it reduces governance to a spectator sport.

High-Profile Cases Fuel Concerns Over Market Manipulation

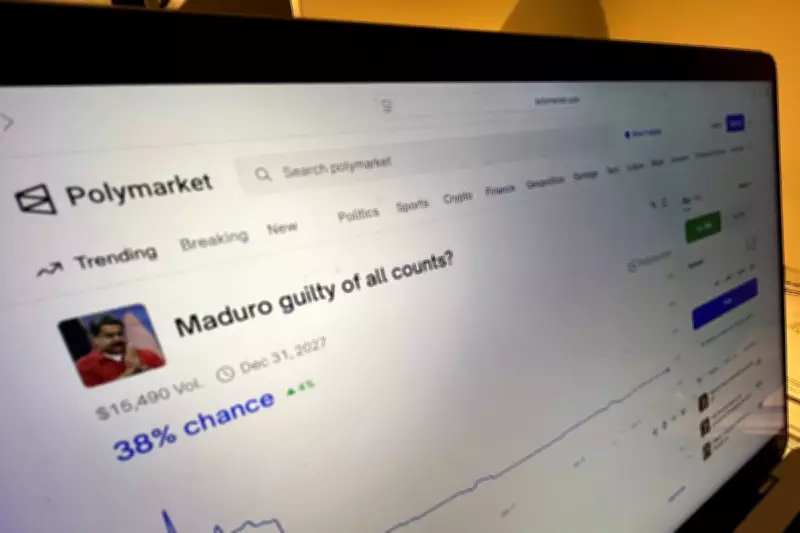

The sheer volume of money flowing into these markets has amplified longstanding concerns about the potential for insider trading. A stark example was reported by The Wall Street Journal, where a single trader profited over $400,000 from a wager predicting the ousting of Venezuelan leader Nicolas Maduro. Notably, activity on Polymarket appeared to anticipate the president's imminent capture by U.S. military forces, sparking debate about whether traders had access to non-public information.

These suspicions were further inflamed by an incident involving White House Press Secretary Karoline Leavitt. Gamblers on Kalshi had placed thousands of dollars in bets on whether a press conference would last longer than 65 minutes. Leavitt abruptly ended the briefing just before that mark, leading to complaints from traders and raising questions about the integrity of such markets. The White House declined to comment on the episode.

"The markets are reacting to real-time political drama in ways we've never seen before," one analyst noted, highlighting how betting odds can shift with breaking news. For instance, the odds of Homeland Security Secretary Kristi Noem being the first Trump cabinet member fired surged dramatically among political bettors following her controversial defence of a fatal shooting in Minnesota.

Legislative and Legal Pushback Gains Momentum

In response to these developments, New York Congressman Ritchie Torres has introduced legislation aimed at curbing potential abuses. The proposed bill would prohibit government employees or officials from betting on events over which they could exert any influence, mirroring insider trading laws in the financial sector.

"If you're both a government insider and a participant in the prediction market, you now have a perverse incentive to push for policies that will line your pockets," Torres told The Wall Street Journal. "That kind of self-dealing is the very definition of corruption. It should be categorically prohibited within the ranks of the federal government."

Legal experts have also pointed to potential violations of the 1936 Commodity Exchange Act, which prohibits wagers on events related to terrorism, assassination, war, or unlawful activities. The act's applicability to modern prediction markets is now under scrutiny as the industry expands.

Global Restrictions and the Future of Political Wagering

Despite their popularity, these platforms face significant regulatory hurdles. Trading on Polymarket is currently banned in over 30 countries, including major economies like the United States, the United Kingdom, Australia, France, Italy, and Ukraine. This patchwork of international restrictions highlights the contentious and legally ambiguous nature of betting on geopolitical events.

Before recent crackdowns, Polymarket had offered contracts allowing users to gamble on potential flashpoints such as a Chinese invasion of Taiwan, further Russian territorial gains in Ukraine, and U.S. military action in countries like Colombia and Cuba. The existence of such markets underscores the complex intersection of finance, information, and global power dynamics.

As hundreds of millions of dollars continue to flow into political prediction markets, the debate intensifies. Proponents argue they provide valuable sentiment data and public engagement, while critics warn of a dangerous erosion of political integrity and the very real threat of corruption from within the halls of government itself.