Premier League superstars Erling Haaland and Mohamed Salah have been identified among Britain's most significant taxpayers, according to the latest research published in the Sunday Times Tax List. The comprehensive study highlights wealthy individuals and families from diverse sectors, including music, arts, high finance, and retail, who contribute substantially to the Treasury's revenue.

Diverse Contributions to the Taxman's Coffers

The eighth edition of the Tax List, released coinciding with the self-assessment tax return deadline, examines various ways the affluent support public finances. For high-earning celebrities like footballers and musicians, contributions primarily stem from taxes on substantial salaries, bonuses, and dividend windfalls. In contrast, business magnates and financiers are assessed based on corporate levies such as corporation tax and employers' national insurance, with calculations adjusted for their ownership stakes in companies.

Gambling Dynasties Lead the Rankings

For the first time, gambling founders Fred and Peter Done of Betfred top the list with an estimated tax contribution of £400.1 million, a notable increase from £273.4 million the previous year. The brothers, who established their company in Warrington, Cheshire, in 1967, saw their ranking boosted by Betfred's gambling duties. Similarly, the Coates family of rival Bet365, including Denise, John, and Peter Coates, secured fifth place with £227.1 million in contributions, amid reports of Denise Coates receiving £260 million in salary and dividends last year alone.

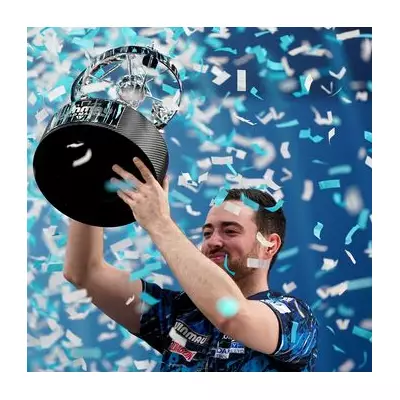

Celebrity Entries and Footballers' Financial Impact

New entries to the list include former One Direction singer Harry Styles, who pays £24.7 million in tax and is set for a record-breaking residency at Wembley Stadium. Footballers Erling Haaland of Manchester City and Mohamed Salah of Liverpool make their debut appearances, with Haaland's £500,000 weekly wage plus extras resulting in an estimated £16.9 million tax payment, while Salah's £400,000 basic salary and bonuses lead to a £14.5 million contribution. Other notable figures include JK Rowling at £47.5 million and Ed Sheeran at £19.9 million, alongside heavyweight boxing champion Anthony Joshua with £11 million.

Economic Trends and Regional Distribution

The total tax paid by the top 100 individuals and families reached £5.758 billion, up from £4.985 billion a year ago, driven by higher corporation tax rates and increased levies on dividends. Robert Watts, compiler of the Sunday Times Tax List, noted the list's growing diversity, with sectors like construction leading representation and finance contributing eight entries, including new entrant Nik Storonksy of Revolut. Geographically, 21 entries are London-based, with significant contributions from the north-west, such as Tom Morris of Home Bargains, who ranks seventh with £209.1 million.

Offshore Residency and Wealth Taxation Debates

Despite their substantial tax payments, approximately one in nine individuals on the list reside outside the UK, in locations like Monaco or Dubai, raising questions about personal tax liabilities. Andrew Speke of the High Pay Centre highlighted the disconnect between the Rich List and Tax List, pointing out that only three of the top 20 wealthiest individuals also rank in the top 20 taxpayers. This discrepancy underscores ongoing debates about the effectiveness of taxing concentrated wealth, as assets often face lighter taxation compared to income.

The Sunday Times Tax List serves as a revealing snapshot of how Britain's elite contribute to public funds, blending celebrity glamour with serious economic implications for the nation's fiscal health.