Britain's private sector has stumbled to its slowest growth rate in seven months, according to fresh data that signals growing economic headwinds for the UK economy.

The latest Purchasing Managers' Index (PMI) flash reading from S&P Global revealed a concerning dip to 52.8 in June, down from May's 54.0 and marking the weakest expansion since November last year.

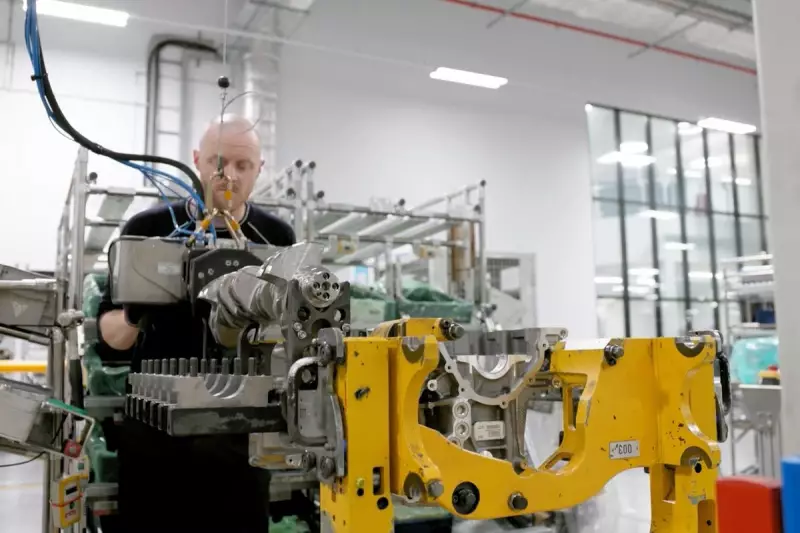

Manufacturing Sector Enters Contraction Territory

Perhaps most alarming is the manufacturing sector's performance, which slipped into contraction with a reading of 46.2 - well below the crucial 50.0 threshold that separates growth from decline. This represents the sharpest downturn in manufacturing activity since the pandemic-induced chaos of January.

The manufacturing slump was primarily driven by:

- Reduced new order volumes

- Ongoing supply chain disruptions

- Rising cost pressures from raw materials

- Weakening export demand

Services Sector Loses Momentum

While the services sector continued to expand, its growth rate slowed noticeably to 53.7 from May's 55.2. The deceleration suggests that consumer-facing businesses are beginning to feel the pinch from the cost of living crisis and reduced discretionary spending.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, warned that "the UK economy has come close to stalling in June" and noted that "the fight against inflation is carrying a heavy cost in terms of heightened recession risks."

Regional Comparisons Paint Bleak Picture

The UK's performance appears particularly weak when compared to international counterparts. Both the eurozone and United States reported stronger PMI figures for June, suggesting Britain may be facing unique economic challenges.

Business confidence has also taken a hit, with optimism about the year-ahead outlook sliding to a 2023 low. Companies cited concerns about:

- Persistent inflationary pressures

- Higher interest rates impacting demand

- Economic uncertainty affecting investment decisions

- Competitive market conditions

The data comes as the Bank of England continues its aggressive interest rate hiking cycle, with policymakers walking a tightrope between controlling inflation and avoiding a severe economic downturn.