Entertainment

Bella Hadid's Near Fall at Chateau Marmont Amid Legal Troubles with Boyfriend

Supermodel Bella Hadid narrowly avoided a tumble in heels outside Chateau Marmont, as details emerge of her boyfriend's recent public intoxication arrest in Texas.

Sports

Arsenal Transfer News: Talks Held for £70m Star Leao as Tillman Admits 'I'd Love to Play There'

Arsenal have reportedly held initial talks with AC Milan's Rafael Leao's representatives for a potential £70m summer transfer, while Bayer Leverkusen's Malik Tillman openly admits his desire to play for the Gunners.

Politics

Lottery Winner's Tragic Fate: Murdered and Buried Under Concrete by 'Friend'

Abraham Lee Shakespeare won $30 million in the lottery, only to be shot dead and buried under a concrete slab in a friend's garden two years later. His killer, Dorice 'DeeDee' Moore, is serving life in prison.

Crime

Father's Five Words After Arrest for Murder of Convicted Rapist Intruder

Ben Batterham faced murder charges after tackling a convicted rapist who broke into his daughter's bedroom. The intruder died from drug-related heart issues, not the restraint.

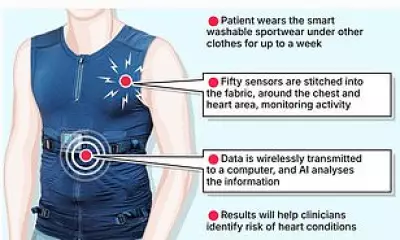

Health

Weather

NYC Mayor Declares Emergency and Travel Ban for Blizzard

New York City Mayor Zohran Mamdani has declared a local state of emergency and issued a travel ban as the city prepares for its first dangerous blizzard in over a decade, with up to 24 inches of snow forecast.

NYC Mayor Declares Emergency and Implements Travel Ban

New York City Mayor Zohran Mamdani has declared a local state of emergency and ordered a travel ban as the city prepares for its worst blizzard in over a decade, with schools closed and non-essential vehicles restricted.

Thailand Hit by 6.5 Magnitude Earthquake After Borneo Quake

A significant magnitude 6.5 earthquake has struck Thailand, as reported by the German Research Centre for Geosciences. This seismic event follows a magnitude 6.8 quake in Borneo, highlighting regional tectonic activity.

US Northeast Braces for Blizzard with Heavy Snow and High Winds

A severe winter storm is hitting the US Northeast, with blizzard warnings from Maryland to Massachusetts, over 6,000 flights cancelled, and residents urged to stay indoors.

East Coast Blizzard: 12,000 Flights Delayed, 18 Inches Snow Forecast

A severe nor'easter batters the East Coast, causing massive flight cancellations and delays while forecasters predict up to 18 inches of snow and dangerous blizzard conditions across multiple states.

Tech

Get Updates

Subscribe to our newsletter to receive the latest updates in your inbox!

We hate spammers and never send spam

Environment

UK Geography Quiz: Test Your Knowledge

Challenge yourself with 100 multiple-choice questions about the geography of the United Kingdom. Perfect for students, travelers, and geography enthusiasts.