The founder of pub giant JD Wetherspoon has issued a stark warning that a significant tax disparity with supermarkets continues to threaten the survival of Britain's pubs, even as Chancellor Rachel Reeves prepares to unveil a new support package for the sector.

Chancellor's £300 Million Relief Package

Rachel Reeves is poised to announce a substantial package of measures designed to alleviate the burden of soaring business rates for pubs, estimated to be worth approximately £300 million. This intervention aims to help the hospitality industry cope with the conclusion of pandemic-era support mechanisms that have been crucial for many establishments.

The Chancellor, speaking from the sidelines of the World Economic Forum in Davos, acknowledged the specific challenges facing pubs. "I do recognise the particular challenge that pubs face at the moment," Ms Reeves stated, "and so I've been working with the sector over the last few weeks to make sure that the right support is in place." She further noted that the government had already implemented permanent reductions in rates for retail, hospitality, and leisure businesses.

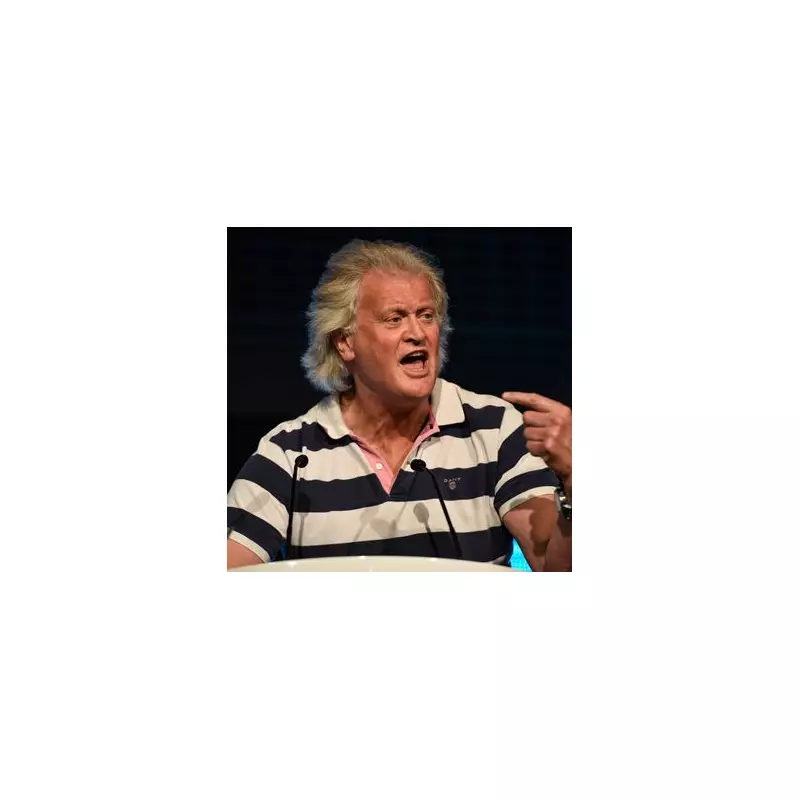

Tim Martin's Call for a Level Playing Field

However, Tim Martin, the outspoken chairman of JD Wetherspoon, argues that the proposed business rates relief does not address a fundamental competitive imbalance. He has long been a vocal critic of the tax advantages enjoyed by supermarkets compared to traditional pubs.

"I'd say Rachel, if you truly value pubs you have to create a level playing field," Mr Martin asserted. "Supermarkets are incredibly powerful and profitable. You tax pubs more than them - we pay 20% VAT on food. They pay zero. We pay 25p rates per pint; they pay about 2p. Anything less than equality will see pubs gradually (or maybe rapidly) decline relative to supermarkets."

His comments highlight a deep-seated issue within the industry, where pubs contend not only with rising operational costs but also with direct, cut-price competition from grocery giants who benefit from more favourable tax treatment on certain items.

Concerns from Broader Hospitality and Entertainment Sectors

The anticipated special treatment for pubs has sparked concerns among other segments of the hospitality and entertainment industries, who fear being left behind. Jon Collins, chief executive of LIVE, which represents music and entertainment venues, criticised the potential policy as "self-defeating."

"The decision to protect pubs while penalising the venues that bring customers through their doors is a self-defeating policy," Mr Collins warned. He explained that operators are facing business rates increases of up to 400%, which could lead to severe financial strain, venue closures, job losses, and higher ticket prices for consumers.

Collins emphasised the symbiotic relationship between live events and local hospitality, citing data from the National Arenas Association. "For every 10,000 people attending a live show, at least £1 million is spent locally in pubs, restaurants, hotels, shops and transport," he noted. The loss of shows, therefore, directly impacts surrounding businesses.

Calls for Extended Support to Hotels

Further calls for the relief fund to be broadened have come from the hotel sector. Darsh Shah, a partner at advisory firm Blick Rothenberg, urged the government to extend the proposed £4.3 billion relief fund to hotels, which are also grappling with significant tax and operational cost increases.

"Some hotels face their rateable values going up by over 300% this year," Shah explained. "On top of this they are contending with the increase in National Insurance Contributions and the Higher National Minimum Wage. A support fund, like the one in place for pubs, would allow hotels to phase business rates bill increases over three years, taking some of the financial pressure off."

The government's forthcoming announcement will be closely watched, as it seeks to balance targeted support for pubs with the needs of the wider hospitality ecosystem, all against a backdrop of persistent economic pressures and competitive tax disparities.