A Florida woman was captured on body camera footage laughing as she was placed in handcuffs for allegedly siphoning hundreds of dollars from a victim through a sophisticated bank phone scam.

Arrest and Charges

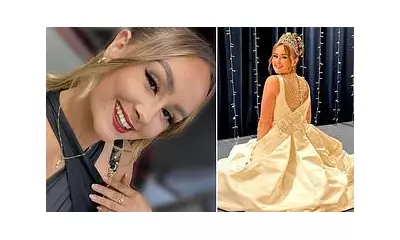

Thalia Jacqueline James, 21, of Daytona, turned herself in on a warrant and was arrested on Friday, January 23. She has been booked into Martin County Jail on charges of grand theft and fraudulently obtaining property under $20,000.

Body Camera Footage Reveals Unusual Reaction

Body camera footage shows the moment deputies arrested James. An officer can be heard saying, 'Turn around for me. Put your hands behind your back,' as James reacts with visible surprise, followed by laughter. The stolen money was traced directly to James' personal bank account, where records show the funds were deposited and later spent, according to an official statement from Martin County Sheriff's Office.

Refusal to Cooperate with Investigators

Deputies reported that she refused to offer an explanation or cooperate when asked about additional suspects who may have taken part in the scam. A judge set her bond at $10,000 following her booking into the Martin County Jail.

Official Statement from Law Enforcement

The Sheriff's Office said in a statement: 'There is nothing funny about the level of fraud we see or the damage it causes to hardworking citizens. Nothing.' Deputies reported that most of the victim's remaining money in this case had already been spent and is now gone.

Part of a Wider Pattern of Financial Crime

Police said James' alleged theft was far from an isolated case. Over the past two years, Martin County residents have lost more than $12 million to bank phone scams. These scams, or account takeover (ATO) schemes as they're often called, involve criminals posing as bank or customer-service employees to trick victims into handing over login credentials, one-time passcodes, or other sensitive information.

How the Scams Operate

Scammers pressure targets to 'verify' their accounts or respond to fabricated fraud alerts using phone calls, texts, emails, or fake websites that closely mimic legitimate banking portals. Once access is gained, the criminals rapidly move funds into accounts or cryptocurrency wallets they control, making the money extremely difficult to trace.

National Impact of Banking Fraud

According to the FBI, these schemes resulted in more than $262 million in losses nationwide in 2025, with thousands of complaints filed. This highlights the growing threat of financial fraud affecting communities across the country.