American Retirees Confront Healthcare Catastrophe as Obamacare Premiums Skyrocket

Across the United States, millions of Americans are facing impossible healthcare decisions as Affordable Care Act premiums have increased dramatically following the expiration of enhanced subsidies. The situation has created what many describe as a life-or-death crisis for middle-income retirees who find themselves trapped between financial ruin and medical catastrophe.

The Nightmare of Unaffordable Coverage

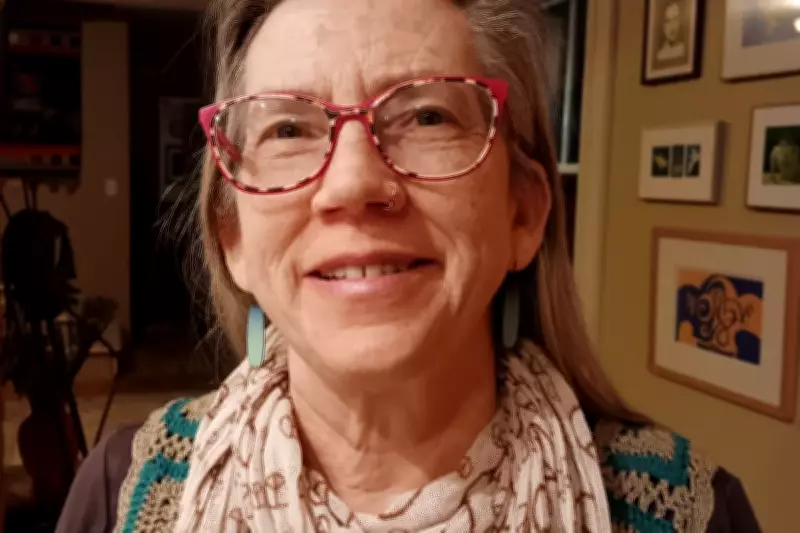

Rachel Phipps, a 63-year-old retired social worker from Kennebunk, Maine, represents the human face of this growing crisis. Like 22 million other Americans enrolled in the Affordable Care Act program, her monthly premium has skyrocketed since enhanced subsidies expired on December 31st.

"I wake up in the middle of the night and I'm terrified of a catastrophic illness or accident happening," Phipps told The Independent. "I'm terrified of something happening and going bankrupt."

Her situation illustrates the dramatic financial impact: last year, Phipps paid $201 monthly thanks to enhanced subsidies. This year, she and her husband face a staggering $2,864 monthly premium with a $7,500 annual deductible per person.

"We calculated that if we took that plan, our healthcare premium and deductible costs for the year could cost us up to $49,368," Phipps explained. "That's approximately 45 percent of our annual income."

A System Failing Those Who Need It Most

The enhanced subsidies, originally introduced in 2021 during the COVID-19 pandemic, served as a crucial lifeline for lower and middle-income Americans. Eligibility extended to people with incomes up to 400 percent of the federal poverty level—$62,600 for individuals or $128,600 for families of four.

Now, many Americans who benefited from these subsidies find themselves in a healthcare limbo. They earn too much to qualify for Medicaid yet remain too young to enroll in Medicare, creating what experts describe as a dangerous coverage gap.

Phipps's personal circumstances highlight this systemic failure. She has a chronic respiratory condition and receives treatment for pre-cancerous cells on her face, yet cannot afford diagnostic tests like CT scans or X-rays.

"I have no insurance to cover these conditions," she said. "We are literally two adults who have worked our entire lives—and we cannot get insurance anywhere."

Cancer Patients Face Their Own Mortality

The crisis extends beyond retirees to Americans battling serious illnesses. Dawn Wheeler from Edwardsville, Kansas, faces metastatic cancer that spread from her original breast cancer diagnosis eight years ago.

Her initial 2026 premium quote reached $2,700 monthly before an income-based subsidy reduced it to $272.32. While significantly lower, this still represents a dramatic increase from the $69 she paid monthly last year, with her deductible jumping from $0 to $3,000.

"The anxiety that this has produced does not help people like me who are fighting chronic illness," Wheeler told The Independent. "At my lowest moments last year, I often thought about my death if I could no longer afford insurance."

Wheeler requires infusions every two weeks and regular MRI and CT scans to monitor her cancer. Beyond premium increases, she faces doubled copay costs—from $15 to $40 for primary care visits and from $30 to $80 for specialist consultations.

"My drugs, my chemo... it's thousands of dollars a month," Wheeler revealed. "I usually hit my out-of-pocket by the end of January, so I'm not sure what's going to happen this month."

The Political Battle Over Healthcare Subsidies

As individuals struggle, a bipartisan group of senators continues negotiations to revive enhanced Obamacare tax credits. Republican Senator Susan Collins leads these discussions with Senator Bernie Moreno, while Independent Senator Angus King also participates.

Phipps has personally appealed to her Maine senators, writing: "I might be one of the 51,000 people who you have heard will die this year." Her frustration has grown so profound that she's now running for a seat in the Maine House of Representatives.

Even if subsidies receive a three-year extension, Phipps faces another barrier: her part-time work at a preschool has pushed her income just over the qualification threshold.

"A lot of people will fall through the cracks," she warned, highlighting how eligibility rules can exclude those most in need.

A National Crisis with Human Consequences

Elsewhere in Texas, Johana Scott battles Stage 3 cancer while facing premium increases from approximately $200 monthly to $1,725 for the same plan after subsidy expiration.

With monthly income of only $1,200, paying her premium would leave nothing for groceries or bills. "I've been crying since December because I don't know what to do," Scott said. "If I don't have my insurance, I am going to die this year."

Wheeler responded forcefully to critics who argue subsidies should end five years post-pandemic: "Look at your grocery bill. Look at all your bills. Everything has gone up since COVID. We need it more than ever."

As negotiations continue in Washington, millions of Americans face impossible choices between financial stability and essential healthcare—a crisis that grows more urgent with each passing day.