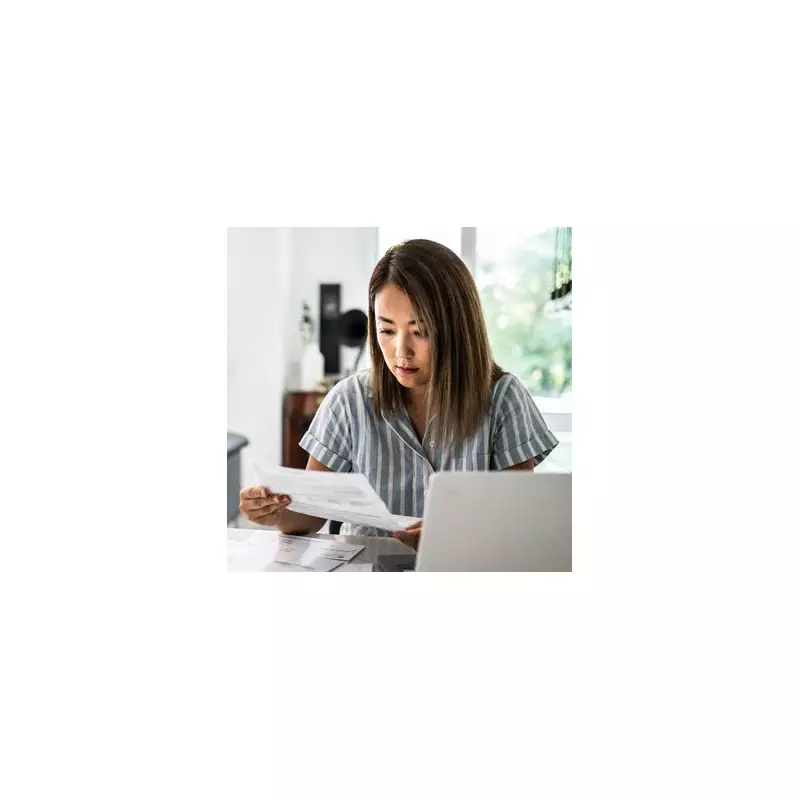

Households across the United Kingdom could be eligible for significant reductions on their council tax bills if they are in receipt of certain state benefits. This financial support, known as a Council Tax Reduction (CTR), is designed to assist those on lower incomes, potentially easing the burden of local taxation.

Understanding Council Tax Reduction

Council tax is a local charge levied by authorities to fund essential services such as waste collection, road maintenance, and local infrastructure. The amount each household pays is determined by the valuation band of their property and the specific rates set by their local council. However, not everyone is required to pay the full amount.

Citizens Advice explains that CTR is a scheme aimed at supporting individuals with limited financial means. "If you're on a low income you might be able to get your council tax reduced," the organisation states. "If you get benefits or have other people living with you, this might affect how much your council tax is reduced by."

How the Application Process Works

To determine eligibility, your local council will request detailed information about your income and personal circumstances. This assessment allows them to calculate whether you qualify for a reduction and, if so, the adjusted amount you will need to pay.

It is important to note that CTR typically does not involve direct cash payments. Instead, the council will reduce the overall council tax liability on your bill. In households with multiple adults aged 18 or over, only one person needs to apply for the reduction, as all residents may share responsibility for the tax.

Eligibility Criteria and Benefit Categories

There are two primary categories of CTR: one for individuals of working age and another for those who have reached State Pension age. Eligibility requirements for the working-age group can vary between different local authorities.

You may be entitled to CTR if you are responsible for paying the council tax and are currently receiving one of the following benefits:

- Guarantee credit as part of Pension Credit, either on its own or alongside savings credit

- Universal Credit

- Income Support

- Income-based Jobseeker's Allowance

- Income-related Employment Support Allowance, which may entitle you to the maximum council tax reduction, subject to any non-dependent deductions

Additional Considerations and Deductions

If you share your home with another adult who is not your partner, your maximum CTR could be reduced due to what is known as a 'non-dependent deduction'. This assumes that the other adult will contribute towards the household bills.

Even if you do not receive any of the listed benefits, you may still apply for CTR if you have low earnings and capital below £16,000. This ensures that support is available to a broader range of individuals facing financial hardship.

Further Discounts and Disregarded Persons

Beyond CTR, you might qualify for a separate 25 per cent reduction on your council tax bill if you live alone or if everyone else in your household is classified as "disregarded". Individuals who may be disregarded include:

- Those under the age of 18

- Apprentices

- Full-time college or university students

- Student nurses

- Foreign language assistants registered with the British Council

- Persons with a severe mental impairment

- Live-in carers for someone who is not your partner, spouse, or child under 18

- Diplomats

For comprehensive details and to initiate an application, it is advisable to consult the official Government website or get in touch directly with your local council. Taking these steps could lead to substantial savings on your annual council tax obligations.