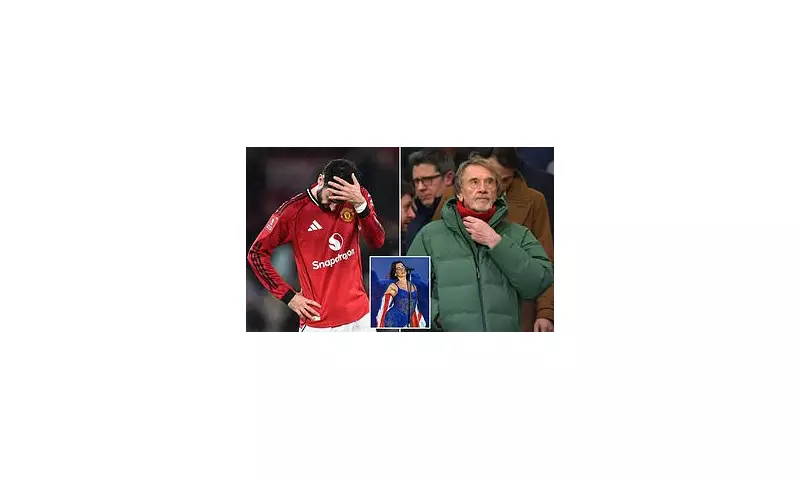

Manchester United are facing a stark financial reality as the club finds itself getting left behind in the global football economy. The latest Deloitte Football Money League rankings have delivered a sobering blow to the Red Devils, who have tumbled to their lowest ever position in the prestigious annual report.

A Historic Low for a Football Giant

The club has fallen to eighth place in the renowned rankings of the world's richest football clubs, marking a significant decline for an institution that has historically dominated these financial tables. This represents a dramatic shift for a club that had never previously fallen outside the top five since Deloitte began compiling the Money League in the mid-1990s.

Manchester United have topped the rankings ten times throughout the report's history, most recently claiming the number one spot in 2017. Now, the footballing giant finds itself more than £300 million behind current leaders Real Madrid, who posted staggering revenues of £1.013 billion. This gap highlights the growing financial disparity between United and Europe's elite clubs.

The Revenue Paradox

What makes United's decline particularly striking is that it comes despite the club boasting record revenues of almost £666 million last year. This paradox reveals how dismal on-field performances have undermined financial standing, allowing rivals to overtake them in the rankings.

The club's financial struggles are largely attributed to a dramatic £45 million drop in broadcast income, directly resulting from their absence from the lucrative Champions League. This comes after United recorded their worst domestic season since 1974, when the side suffered relegation.

Football finance expert Kieran Maguire explained to Daily Mail Sport: "Each place in the Premier League is worth £3.5 million, so a 15th place final position hit the club hard." Despite this, United still managed to record the highest matchday revenues in the Premier League, demonstrating the enduring loyalty of their fanbase.

Future Challenges Loom Large

The situation appears set to worsen for Jim Ratcliffe and INEOS's ownership, with United's position expected to plunge even lower in coming years. The club's early exit from both the FA Cup and League Cup, combined with no European football this season, means United will play just 40 matches - their fewest in 111 years.

Maguire warned: "Expect United to potentially fall further in the table in 2025-26 due to the fewest number of games taking place at a still sold-out Old Trafford each match, alongside zero UEFA monies and a £10 million penalty from sponsors Adidas for not qualifying for the Champions League."

Supporters Feel the Pinch

The financial pressures have translated directly to fans, with the Manchester United Supporters Trust describing recent ticket price increases as a "kick in the teeth." This came following the club's worst domestic season since 1974 and was compounded in September when Ratcliffe hiked ticket prices for an academy fixture.

Further concerns have emerged about potential job losses, with Ratcliffe having made approximately 250 staff redundant in 2024 and announcing a further 200 cuts last year. Additional austerity measures have included salary reductions for club ambassadors like Sir Alex Ferguson and the closure of the paid-for staff canteen.

Premier League's Changing Financial Landscape

For the first time in the Deloitte report's 29-year history, no English side made the top four positions. Liverpool led the Premier League contingent in fifth place, having leaped from eighth in the previous year's rankings with revenues around £730 million.

Maguire noted Liverpool's success: "Liverpool have become champions both on and off the pitch as they benefitted from modest progress in the Champions League, which is critical as it generates 3.5 times as much prize money as the Europa League."

The Reds also capitalised on non-football revenue streams, hosting concerts by global superstars including Taylor Swift, Bruce Springsteen, and Dua Lipa at Anfield. Their new deal with Adidas helped boost merchandise sales through global megastores.

Other English Clubs Making Gains

Aston Villa demonstrated one of the biggest surges up the table, jumping above established European giants AC Milan, Juventus, and Saudi-owned Newcastle into 14th position. Their revenue increased by 45 percent to more than £390 million, boosted by a run to the Champions League quarter-finals and new sponsorship deals with Adidas and Betano.

Manchester City experienced a rare setback, plummeting from top position in 2023 to sixth place with revenues of £723 million. However, unlike their cross-city rivals, City's future looks brighter with a new £1 billion deal with Puma and an expanded North Stand set to increase matchday revenue.

The Premier League's Collective Strength

While no English clubs reached the top four, Premier League sides still demonstrated remarkable financial muscle, making up half of the biggest 30 clubs globally. Six English teams featured in the top ten, with Arsenal (7th), Tottenham (9th), and Chelsea (10th) joining Liverpool, United, and City.

Maguire highlighted Arsenal's achievement: "Arsenal finished above Manchester United for the first time in many years. A semi-final place in the Champions League helped drive broadcasting prize money from UEFA along with a second-place finish in the Premier League."

The financial depth of the Premier League was further emphasised by clubs like Brentford, whose revenue of £180 million placed them 28th - above Flamengo, the biggest club in Brazil. Maguire observed: "It means that Brentford playing in a 20,000-seat stadium generate more income than any club in North, Central or South America on the back of the Premier League's television deals."

This financial power creates a more competitive domestic league, allowing smaller clubs substantial budgets that rival all but Europe's elite. As Manchester United face their financial reckoning, the Deloitte Money League reveals a football landscape where commercial success increasingly depends on both on-field performance and innovative revenue generation.