Fresh analysis of the UK housing market has revealed a significant downturn in London property values in the immediate aftermath of Chancellor Rachel Reeves' autumn budget. Homeowners in the capital have been hit with the largest monthly loss in the country.

Capital Takes the Biggest Hit

According to the latest House Price Index from estate agents Purplebricks, property prices in London fell by 1.9 per cent between September and October this year. This sharp drop wiped an average of £10,541 off the value of a home, bringing the typical price in the city down to £547,468. The annual decline was even more pronounced, standing at 2.4 per cent.

The pain was not evenly spread, with values falling in 19 of London's 33 boroughs. The most expensive areas suffered the most dramatic six-figure losses over the twelve months to October.

Prime Boroughs See Staggering Losses

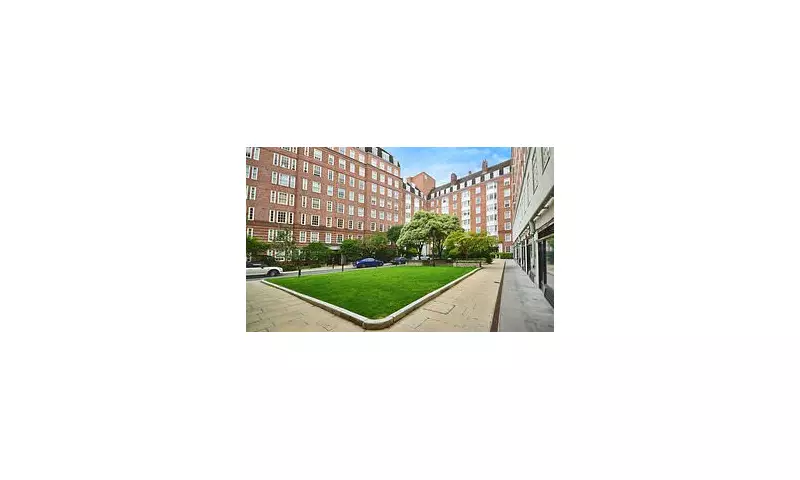

Kensington and Chelsea led the declines, with homes shedding £56,975 in a single month and a colossal £236,342 over the year. Despite this, the average property in the borough still commands a staggering £1,194,726.

The City of London experienced the most severe monthly plunge, with prices falling by £68,103, leaving the average home in the financial district valued at £607,399.

Westminster completed the trio of boroughs with annual losses exceeding £100,000. Properties in the political heartland lost £170,763 over the year and £30,352 in October, reducing the average home value to £889,935.

A North-South Divide Emerges

Beyond London, the South West and Scotland also saw prices dip by 0.6 per cent in October, with average homes costing £302,526 and £191,825 respectively.

In stark contrast, the North East of England saw property values rise by 1.3 per cent in a month, pushing the average price to £163,153. Wales was the second strongest performer, with a 1.1 per cent monthly increase taking the average Welsh home to £210,657.

Nationally, house prices actually increased by 1.7 per cent (or £5,000) over the year to October, making the average UK property worth around £270,000. The biggest annual winners were homeowners in Orkney, where prices rose by £37,386, and the Vale of White Horse in Oxfordshire, which saw an average increase of £33,537.

Market Experts Cite Seasonal and Policy Concerns

Tom Evans, Sales Director at Purplebricks, commented on the figures, noting that monthly falls at this time of year are not unusual. "December is traditionally a period when activity slows," he said, "and this year many buyers and sellers have been holding back, awaiting clarity on future housing policy and taxation plans from the Government heading into 2026."

He specifically pointed to concerns around higher-value properties and second homes, suggesting that fears over a potential mansion tax may be causing hesitation at the top of the market. Despite the recent softening, Evans expressed confidence, stating: "Overall, 2025 has been a resilient year for the housing market. We remain confident the property market will regain momentum in the new year."