More than one hundred independent schools have shut their doors in the wake of the Labour government's contentious decision to impose VAT on fees, a move that has directly affected the education of tens of thousands of children.

A Grim Tally of Closures

Julie Robinson, chief executive of the Independent Schools Council, revealed the stark figures on the first anniversary of the policy's introduction. A total of 105 schools have closed, impacting approximately 25,000 pupils. This number includes 15 institutions that were merged with others. Robinson painted a bleak picture for the coming years, warning that further closures are likely as the cumulative effects of VAT and other tax measures take hold.

"While there is a combination of factors contributing to school closures, we know that there are some for whom the Government's decision to tax education is a bridge too far," Robinson told The Mail on Sunday. The reality of these closures stands in stark contrast to the government's initial forecasts, which predicted no schools would close as a result of the policy.

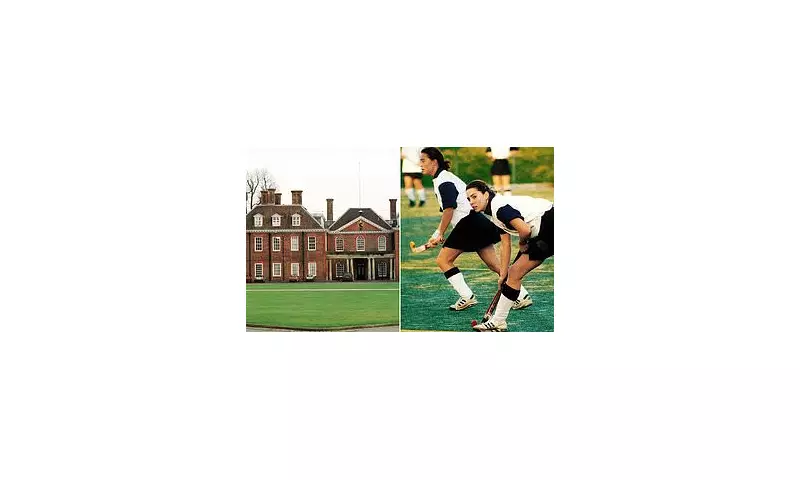

Financial Strain Hits Prestigious Institutions

The financial pressures are being felt across the sector, from small local prep schools to some of the country's most famous establishments. Marlborough College in Wiltshire, the alma mater of the Princess of Wales, has reportedly been forced to turn off heating during holidays to save money, according to an anonymous staff member. The school, which charges up to £61,800 a year and has been mooted as a potential destination for Prince George, has also closed its annual summer school after 50 years, citing financial pressures including VAT.

Closures have been geographically widespread. While many schools in the North and Midlands have shut, nearly one in five of the closures—19 schools—have been in London and the surrounding area. Notable casualties include:

- Park Hill School in Kingston and Falcons School in Putney, which both cited the VAT policy as the final straw.

- The Old Palace of John Whitgift School in Croydon, Ursuline Prep in Ilford, and London Acorn in Morden, which closed last year.

- More recent closures include The Cedars School in Croydon and Oak Heights in Hounslow.

Other high-profile shutdowns include the prestigious Queen Margaret's School for Girls in York, founded in 1901, whose governors said they were "unable to withstand mounting financial pressures."

Government Response and Future Projections

The scale of the closures contradicts early government assurances. It was only in March of last year, after a dozen schools had already shut, that Treasury Minister Torsten Bell admitted the policy would have casualties, suggesting 100 schools 'could close over three years'. The government had originally estimated that as few as 3 per cent of private school pupils—around 18,000 children—would leave the sector entirely.

A government spokesman defended the policy, stating: "This manufactured crisis of pupils leaving the private sector and putting pressure on the state system has failed to materialise." They emphasised that ending tax breaks for private schools is projected to raise £1.8 billion a year by 2029/30, funds earmarked for public services and supporting the 94 per cent of children in state schools.

However, with sector leaders warning of a difficult road ahead in 2026, the debate over the VAT raid's impact on educational choice and diversity continues to intensify.