Water Industry's Historic Spending Spree Confronts Major Implementation Hurdles

Workers from specialist contractor Glenfield Invicta recently undertook a particularly challenging repair operation at Thames Water's Queen Mother reservoir near Heathrow airport. When a critical sluice gate failed twenty-four metres below the water's surface, draining the vast reservoir containing thirty-seven million cubic metres of water was simply not feasible. This necessitated a complex, high-risk operation where helmeted divers were limited to ninety-eight-minute working stints in the high-pressure environment to cut out the broken equipment and install replacements.

This intricate project, which took over a year to complete and concluded last October, serves as a potent symbol of the extensive repair and upgrade work now facing Britain's water infrastructure. Water companies across England and Wales are preparing for an unprecedented wave of such projects, as the industry commits to the largest capital expenditure programme in its history, with plans to spend £104 billion between 2025 and 2030.

Regulatory Overhaul and the Legacy of Underinvestment

This monumental spending commitment follows decades of acknowledged underinvestment within the privatised water system. The political context shifted significantly this week with the Labour government announcing plans for a comprehensive regulatory overhaul. The proposal aims to ensure companies invest sufficiently to prevent sewage overflows and reduce leaking pipes, replacing the current regulator, Ofwat, with a new system that will assess each company individually rather than setting industry-wide targets.

However, experts warn this regulatory transition will take time. In the interim, the pressing need for infrastructure upgrades remains. In December 2024, Ofwat granted suppliers permission to increase customer bills by an average of thirty-six percent over the five-year period to facilitate the £104bn spending plan, a sharp rise from the £51bn invested in the previous five years. This decision carried substantial political weight, occurring amidst widespread public anger over frequent sewage spills into rivers and coastal waters.

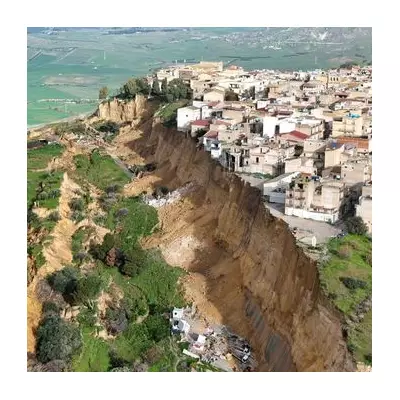

The necessity for substantial investment is hardly disputed, given the system's visible strains. South East Water faced severe criticism this month after thousands of residents endured days without supply, an incident that followed a similar pre-Christmas outage. A consistent pattern of serious pollution issues has also led to six companies being prohibited from paying executive bonuses.

The Capacity Challenge: Contractors and Inflation

Now that funding has been secured, a critical question emerges: can the water companies actually spend the money effectively? The industry is not operating in a vacuum. The Labour government itself has an extensive construction agenda, including building 1.5 million homes annually, executing £28bn in energy grid upgrades, and progressing major projects like new nuclear reactors and a proposed £33bn Heathrow runway.

This creates a perfect storm for resource scarcity. Dieter Helm, an Oxford University professor of economic policy, highlights the fundamental constraint. "What is the capacity to build all this? Very little," he states. "There's a scarcity of contractor supply, a scarcity of materials." He notes that global infrastructure projects typically overrun by thirty percent on both time and cost, raising serious concerns about inflationary pressures within the UK construction sector.

Despite these challenges, engineering firms spy significant opportunity. Companies like Galliford Try, Kier, and Morgan Sindall are among those expected to benefit. Costain, for instance, is already engaged on projects for at least six water companies. Its chief executive, Alex Vaughan, notes that water companies are engaging contractors earlier than usual to secure vital expertise, offering longer-term frameworks that aid in recruitment.

Financial Distractions and Operational Hurdles

Executing a multi-billion-pound investment programme requires focused, experienced management teams. For several water companies, significant financial distractions threaten this focus. Thames Water remains embroiled in protracted talks to restructure its enormous debt and avoid temporary nationalisation. Ofwat has also flagged South East Water and Southern Water for active financial monitoring, with six other companies on an "elevated concern" list.

Furthermore, six companies are appealing to the Competition and Markets Authority for even greater bill increases, diverting managerial attention from overseeing complex capital projects. The front-loading of bill increases into this financial year, intended to accelerate cash flow to companies, has also intensified political and customer backlash.

Martin Young of Aquaicity consultancy observes a divergence in readiness. "The listed companies on balance are performing better than the unlisted companies," he suggests, indicating that financially stretched operators may find the delivery challenge particularly tough.

A Race to Restore Trust

The industry acknowledges the high stakes. Stuart Colville, deputy chief executive of Water UK, asserts that companies face "really strong financial penalties if they fail to deliver," and recognises that delivery is essential for restoring public trust and justifying bill increases. The planned work includes increasing capacity at 1,700 wastewater treatment works and upgrading 3,000 storm overflows.

However, scepticism remains among campaigners and analysts. James Wallace, chief executive of River Action, argues that water companies have already received sufficient funds to address systemic problems and predicts further "disappointment and more criminal pollution." Professor Helm is equally cautious, stating he "would be stunned if they get through this capital programme in this period of time."

The coming years will test whether the water industry can translate its historic financial commitment into tangible improvements for England and Wales's creaking water infrastructure, or whether the challenges of capacity, cost, and corporate focus will undermine this critical national endeavour.