The architect of the government's water plan has asserted that the privatisation of England's water industry is not the fundamental reason for its widespread failings, cautioning against simplistic solutions like nationalisation. Sir Jon Cunliffe, a former Bank of England deputy governor who authored a recent review of the sector, emphasised that the current system can be made to work with significant reforms.

Review Focuses on Accountability and Regulatory Overhaul

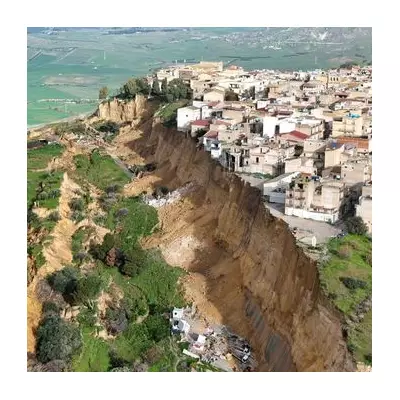

Sir Jon Cunliffe was enlisted by the Labour government to address critical issues plaguing the water industry, including the sewage scandal, frequent tap water outages, and inadequate drought preparedness. In his report, he proposed measures to enhance accountability, such as making it easier to remove failing water company CEOs. This comes amid pressure on David Hinton, the chief executive of South East Water, to resign after prolonged water shortages affected tens of thousands in Kent and Sussex.

Government White Paper Adopts Key Recommendations

The government responded to Cunliffe's findings with a white paper this week, incorporating many of his suggestions. These include establishing a supervisory model, increasing technical expertise within a new super-regulator, and implementing turnaround regimes to compel water companies to address problems swiftly. Notably, Cunliffe was instructed not to consider nationalisation in his review, focusing instead on improving the existing privatised framework.

England and Wales remain the only nations globally with a fully privatised water system, a model that has faced intense criticism. Companies have been accused of prioritising dividend payments over essential investments in infrastructure like pipes and reservoirs, leading many campaigners to advocate for public ownership.

Cunliffe Argues for Evidence-Based Solutions

However, Cunliffe challenged this view, stating, "You can't fix these problems with one simple solution. If we nationalised the system tomorrow, we wouldn't necessarily solve all the problems that we have to solve." He explained that his report examined water systems worldwide and found no conclusive evidence that alternative ownership structures are inherently superior. "We didn't think the problems the sector was facing could just be laid at the door of privatisation and profit," he added, highlighting mixed results from international comparisons.

He insisted that the privatised system "can work" but acknowledged it would require substantial effort and change. Cunliffe also proposed holding senior managers personally accountable, drawing parallels with the financial sector, where such measures can lead to resignations. He described the recent water outages in Kent and Sussex as "clearly unacceptable," underscoring the need for robust accountability mechanisms.

Campaigners Criticise White Paper and Profit-Driven Model

Campaigners have reacted negatively to the white paper, arguing that reforms will fall short unless the profit-driven model is directly addressed. James Wallace, CEO of River Action, contended, "None of these reforms will make a meaningful difference unless the failed privatised model is confronted head-on. Pollution for profit is the root cause of this crisis."

Feargal Sharkey, a water campaigner and former Undertones singer, echoed this sentiment, stating, "Ministers have failed to grasp the underlying issue, which is corporate greed. The only people who will be paying for this are customers and bill payers." Cat Hobbs, CEO of We Own It, advocated for public ownership to include household representatives and anti-sewage groups on water company boards, ensuring greater accountability.

Controversy Over Fines and Investment Priorities

The white paper has also sparked controversy for including measures that could reduce fines for water companies. The rationale is that penalising companies heavily might hinder their ability to invest in infrastructure improvements. For instance, Thames Water faces over £120 million in fines for sewage dumping and other failures.

Cunliffe defended this approach, explaining, "You have to make sure that [letting companies off fines] isn't an easy option – there need to be sanctions for poor performance. But if your answer to poor performance is to take money out of the company which they cannot invest, or leave with a shadow hanging over it for five years, it is not going to help customers to get things fixed." He warned that excessive punishment could lead to "a dead water company, which is in no one's interest."

As the debate continues, the focus remains on balancing regulatory oversight with incentives for investment, all while addressing public concerns over service reliability and environmental impact.